Walk Your Talk

What was the emotional arc of the month?

Another month went past. On January, I had promised myself that I would publish here as often as possible for a year. Monthly, to the very minimum. I also had pledged never to publish just for the sake of publishing. The signal to noise ratio in our digital lives is already pretty bad. No need to make it worse.

The two goals were clearly in contrast. I struggled to find back a voice and set something out against the static canvas. Starting again is hard. It's much easier not to break an habit than to return to it. I have a feeling that all my efforts here are spent learning this one single lesson: how to get back up, face the white canvas, and pick up steam again.

Today, very conscious of this spread no noise principle, I have assembled what I believe are the most salient bits and pieces of the month. These reflections brought me value and insight, but they could be perfectly anachronistic today.

Why a curated retrospective of a month in the US financial markets, you may ask. Wall Street has mastered one thing: selling greed and fear. They are the human’s most powerful fantasies. Markets are where stories meet action, shaped by our collective (buying) power. When narratives are traded, prophecies are realised.

What was the story arc of this month?

American writer Kurt Vonnegut had an original master's thesis idea. What if we could study how narratives oscillate from their beginning to the end across the "Good fortune v. Ill fortune axis"? The theme of thesis was simple: stories have a handful of shapes. He was ahead of his times. This was 1947. The UChicago committee rejected it unanimously: this is not anthropology.

Fast forward to 2016. Researchers from Universities of Vermont and Adelaide mapped out a large corpora of narratives onto six prevalent emotional arcs (The Atlantic). The inferences are made using natural language processing, singular value decomposition and clustering (Journal article). Their conclusions? The most popular stories follow one of six arcs: “rags to riches” (rise), “tragedy” (fall), “man in a hole” (fall-rise), “Icarus” (rise-fall), “Cinderella” (rise-fall-rise), or “Oedipus” (fall-rise-fall).

So, what was the story arc of this month?

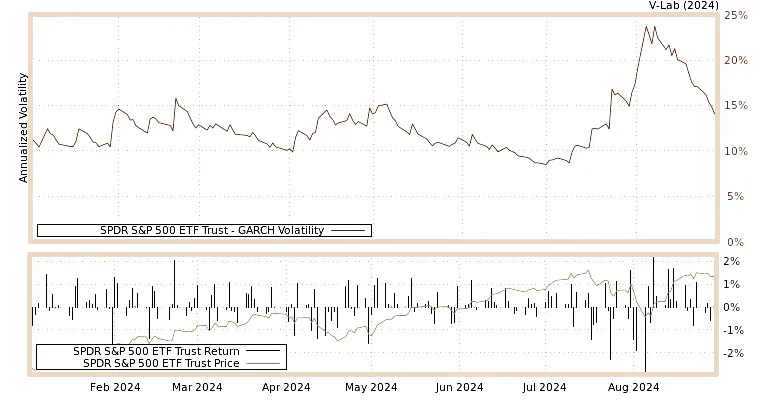

Down, up, up. August started with fear. The contagious Japanese kind.

While everyone was watching the Olympics, for a day or two recession odds spiked. The offices were empty while implied volatility (^VIX) hit a fresh record. For a day, every Bloomberg commentator put their anxious hat on.

Then, it recovered. At first, decisively. Then, the pace slowed in the last third of the month. Sentiment shifted. Everyone forgot what happened. The traumatic week left few scars. Credit markets were healthy. There was no liquidity crunch. Some deleveraging ensued with cautious retracing and rebounds.

Observing what happened afterwards often may give us a false sense of comfort. Looking forward, the commentary seem to have returned to the usual discreet sense of subdued optimism. Sure, Buffet cut its Apple stake.

Some portfolio managers are building more defensive positioning. Many can finally pitch their clients rotation. I find the idea perverse. It is rooted in the biased view that “Everyone must have their time under the spotlight”. Mmm... Nope. Sure, in July, the Russell 2000 (US small-caps) had one of their best week in years against the S&P. Now, things look different. Why would they outperform?

My intuition was that August was an important turning-point. A test, if you will. If the S&P500 would close green in August (+2.3 %) , it would sail relatively smoothly until the end of the year with similar profit. The large-cap market demonstrated resiliency to some strong stressors. Nvidia earnings last Wednesday were a turning point. They were good, the last quarter revenue hit $30bn (+122% YoY). Yet, they underperformed the maximalists' hopes and the share price took a hit.

The AI market is growing fast, but how big of a monopoly can it accrue in the GPUs chip designer? To justify its valuation, it would need to command a market share similar to Apple's in the consumer electronics market. For how long will its chips be superior in the matrix multiplication essential for AI?

Next, there are the mid September Fed's meeting and the US elections in November coming up next. Their outcomes are more predictable. Fed is hinting at the cus: 25 bps, 50bps twice less likely. A reluctance to cut rates can be felt across the last Fed actions. After all, the faster they cut the faster they’d loose leverage.

Meanwhile, in the midst of the Maelstrom, the most acute observers talked about the new breeds of correlation trades popular on Wall Street that got hit that August day: the dispersion trades. That's when you trade index volatility against single stocks volatility. The index is usually less volatile then its single names. The index can be calm in aggregate, while its constituents swing up and down.

For a while in June we had some of the lowest S&P 500 volatility. It had been pushed to artificial lows. There was a race to the bottom to sell index volatility.

This is also political. As Morgan Staley noted once "there is a bountiful opportunity to pick the winners, avoid the losers and create a portfolio that meaningfully beats the benchmark if the dispersion of the constituent stocks is high". Dispersion means there’s more alpha to be captured by active managers. Hence, fees.

After we understand dispersion, we really need to understand skew. The key question here is asking what's more in demand in the option markets? Capturing the unexpected upside, or protecting portfolios from unforeseen downsides?

Tail risks. Tail opportunities. Everyone is beginning to realise how fat is the tail...How common are the (very) uncommons on aggregate. In this regime, asymmetric odds abound.

Yet, core macro questions remain. Where is the US dollar weakness going to land as we ease into elections? Will we see a turnaround? How many rate cuts can we expect until the end of the year? In January, the main street analysts were pricing in over six rate cuts. Now 1 - 3 seem more probable.

The broader long-term questions are relative to the job market. Not a surprise that the markets are jumpy around unemployment data releases. Both long-term investors and short-term traders watch this carefully. The larger underlying story is fairly simple.

How will the massive AI productivity gains impact consumers' discretionary spending? The US is a consumption-based economy. Households incomes depend on labour conditions. Higher indiscriminate productivity entails less workers are needed to achieve the same output. With so many "artificial interns" available at near no cost, why would companies still train and hire the same amount of new graduates? From the pandemics onwards, there's an evident slow down in job postings. Some of this has nothing to do with AI, as we can see even Construction roles have been hit. Yet, software Engineers seem to be hit the most.

What’s the best non-exotic bet anyone could have made?

Right on the aftermath of the Biden-Trump debate, it was clear Biden was not going to make it. He came out devastated from the encounter. There was no way the Democratic Party establishment would have went all the way to the elections backing a candidate that was running with less than 20% odds! A change of jockey was in the cards.

A dollar placed on Kamala back then would have turned into 50 $ at today's Polymarket rates. That's 50x in two months, an astonishing annualised return.

Obviously, this was highly profitable because there was a large chunk of US population, that was willingly ignoring this probability. Biden supporters. Media establishments. For a good while in July, they were loudly in denial and kept pushing the narrative that Joe Biden would not step down.

As a rule of thumb, bet against the loudest and most irrational mob. Usually, in the long run, it turns out alright.

Outside Questions

Longevity: Why We Die? Nobel Prize-winning molecular biologist Venki Ramakrishnan delves into the question of aging from first-principles. It’s a must read book of 2024. On YouTube, you can find his Harvard Science Book Talks and Research Lectures.

History: How did we progress? Calculating Empires. A Genealogy of Technology and Power Since 1500. It is a large-scale research visualisation exploring how technical and social structures co-evolved over five centuries. The aim is to view the contemporary period in a longer trajectory of ideas, devices, infrastructures, and systems of power.

Biology. “There are certain species in every ecosystem that play a very specific and important role: dying, inexplicably”. The proverbial canaries in the coal mine. They pick up subtle cues from the ecosystem as a whole.

Conversations. Emergent behaviour happens when “there’s no point in looking under the hood”. To assess the mathematical proof of Fermat Last Theorem, you’d waste your time studying the psychology of Andrew Wiles or how its brain works. Breaking down the magic of good conversations is similarly pointless. They just happen to carry emergent properties.

Have a great start of September.

Talk soon 🎈

David